Gold is More Volatile Than Ever – Is It Still Worth Buying in 2025?

Gold has always been seen as a timeless hedge against uncertainty, but in 2025, its status is under intense pressure. Gold is more volatile than ever, driven by a mix of global trade conflicts, inflation concerns, and political upheaval. With Donald Trump’s re-emergence on the political stage, tensions between the U.S. and China escalating again, and central banks reacting unpredictably, the price of gold has entered a new era of instability. Investors now face urgent questions: Is gold a good investment in 2025? Shall I buy gold now or wait? Is it worth buying gold with prices so unstable? Will gold keep going up, or will gold crash soon? Let’s explore what’s driving this chaos in the gold market—and whether it still deserves a place in your portfolio.

Trump’s Political Comeback and Gold’s Reaction

One of the biggest shockwaves to hit global markets in 2025 is Donald Trump’s aggressive return to U.S. politics. As he leads polls ahead of the upcoming election, Trump has vowed to reintroduce protectionist trade policies, including steep tariffs on Chinese imports, and has reignited fears of a full-blown trade war. Gold historically benefits from political instability, but Trump’s unpredictability adds a new dimension. For instance: In February 2025, gold surged 5.2% in a single week after Trump threatened to impose 25% tariffs on Chinese technology products. By March 2025, gold prices plummeted 3.8% when Trump signaled a willingness to negotiate, catching traders off guard. This whipsaw action has left investors confused. Is gold still a hedge, or has it become a speculative play?

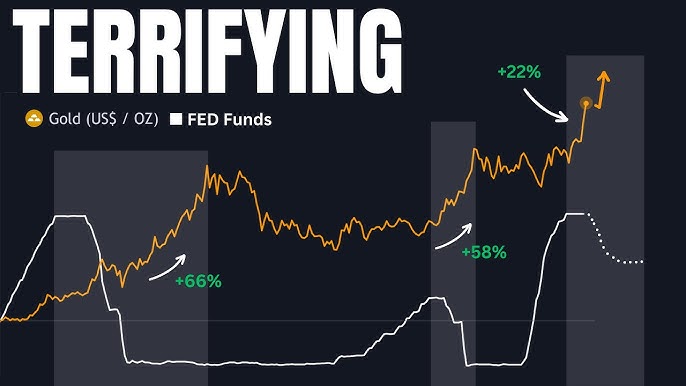

Inflation, Interest Rates, and Central Bank Moves

Beyond Trump, global inflation trends are creating additional uncertainty. While the U.S. Federal Reserve paused interest rate hikes in early 2025, European and Asian central banks have taken divergent paths, some tightening further, while others cut rates to stimulate growth. These mixed signals are impacting gold: Higher interest rates typically weaken gold, as yields on other assets rise. But inflation fears have kept demand for gold alive, especially in regions where currencies are under pressure. Gold’s price in 2025 has ranged from $1,780 to $3,430 per ounce, reflecting these conflicting forces.

Trade Wars Beyond the U.S.

It’s not just about Trump. China, India, and the European Union have all engaged in their own trade disputes, further disrupting global markets. These conflicts, often accompanied by currency devaluations and shifts in commodity markets, continue to influence gold’s volatility. In April 2025, gold saw a sharp rally after India imposed tariffs on Chinese electronics, causing fears of a broader Asian trade war.

Should You Buy Gold Now?

Given these dynamics, the question remains: is it worth buying gold now? If you believe Trump’s policies will escalate into more chaos, gold could see further upside. If global inflation remains stubborn, gold might hold its value despite higher interest rates. However, if trade tensions ease or markets stabilize, gold could correct sharply. In short, gold is no longer just a “safe haven”—it’s a geopolitical barometer.

Conclusion: Gold’s Uncertain Future

The gold market in 2025 is driven by more than just supply and demand—it’s at the mercy of political agendas, central bank strategies, and global trade wars. With Donald Trump’s influence rising again and the world economy teetering between growth and recession, gold’s future remains uncertain. For those wondering is gold a good investment, caution is key. Gold offers potential rewards, but with risks that demand close attention.